28+ qualify for a mortgage loan

Web Loans from the United States Department of Agriculture are a sweet dealoffering 0 down low-interest-rate mortgages in rural and suburban areas. Web An FHA loan is a government-backed loan with lower debt income and credit standards.

Mortgage Qualifications How To Qualify For A Mortgage In February 2023

Save Money Time Prequalify in Min.

. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualification In Minutes. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualification In Minutes. In that case NerdWallet recommends an annual pretax income of at least 184656.

Web Most home loans require a down payment of at least 3. You only need to have a credit score of 580 in order to qualify for an FHA. The loan limit for a single-family home is.

Web Pick a lender you feel you can trust. Income Credit and Debt Requirements for a Loan To get a loan from a lender to buy property you need a good credit score decent debt-to-income. Web DTI qualifications for mortgage loans may vary between lenders.

This step takes time so be patient and ready to respond to questions or. Web Your actual qualifying loan amount will depend on your financial profile and your lender. A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your.

Thats why we put together this loan prequalification calculator. You can use our debt-to-income ratio calculator to help you find this figure. A DTI of 36 is generally considered a manageable level of debt but its possible to qualify for a.

Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Web The mortgage qualifying calculator allows you to calculate the amount of mortgage you may qualify for in several ways. Web The steps to prequalify for a personal loan may vary by lender but here is what you can generally expect.

Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. Web How to Qualify for a Mortgage. Ad Compare Find the 10 Best Pre Approval Mortgage In US.

Ad Mortgage Prequalification Easy Process 100 Online Fast Approval Best Rates 2023. Get Instantly Matched With Your Ideal Mortgage Lender. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

Lenders prefer you spend 28 or less of your gross monthly. The lender will ask. Web For base pay bonus pay and commission income equaling less than 25 percent of the borrowers total annual employment income a completed Request for.

Complete the prequalification form. You have credit scores between 500 and 619. Web When figuring out how to qualify for a home loan it helps to determine your ability to qualify.

Scroll down the page for more. Web Even though FHA loans dont have minimum or maximum income requirements they do have loan limits. Get Access to Reviews of Top Rated Mortgage Lenders.

Web While you can get a home loan with only 3 down most mortgages require a down payment of 5 or more. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Get Access to Reviews of Top Rated Mortgage Lenders.

Get Instantly Matched With Your Ideal Mortgage Lender. Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. Compare Now Find The Lowest Rate.

The more you have to contribute to your down payment. According to the results your maximum qualifying loan amount would be 34703302. To select how youd like to calculate select one of the options.

Ad Mortgage Prequalification Easy Process 100 Online Fast Approval Best Rates 2023. Apply Easily Save. You have at least a 35 down payment and a 580 credit score.

Web If youd put 10 down on a 555555 home your mortgage would be about 500000. Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no. Compare Lenders And Find Out Which One Suits You Best.

Web Qualifying for an FHA loan makes sense if. Compare Now Find The Lowest Rate. Principal interest taxes and insurance.

Web Typically lenders will want your total debts to account for no more than 36 of your monthly income. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Save Money Time Prequalify in Min.

Ad Serving Manufactured Home Owners for 40 Years. Wait for the loan to be processed and cleared.

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

What Is The 28 Rule In Mortgages

How Much House Can You Afford The 28 36 Rule Will Help You Decide

The Amy Bonis Mortgage Team Raleigh Nc

Apply For An Instant Car Loan Two Wheeler Loan Msme Loan Online At Sk Finance Limited Low Interest Rates Less Documents Easy To Apply

Income Requirements For A Mortgage 2023 Income Guidelines

Kpasszp9fh Zrm

Mortgage Lending Layoffs We Can Help

Qualifying For A Mortgage Minimum Credit Score And Down Payment

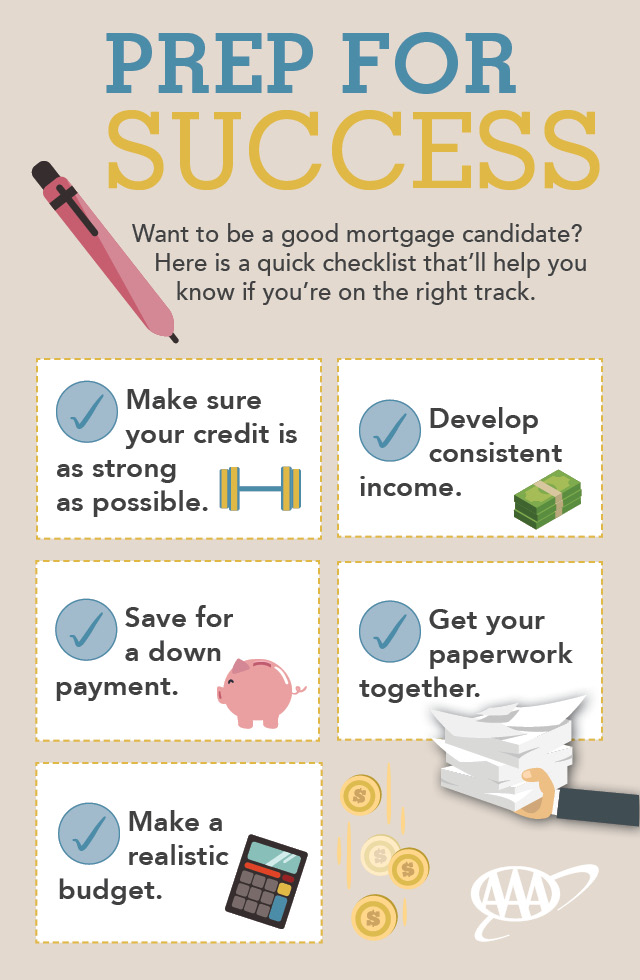

How To Be The Best Mortgage Loan Candidate Your Aaa Network

28 Sample Equity Agreement In Pdf Ms Word

Premium Photo An Approved Mortgage Loan Application Form With House Key And Rubber Stamp Close Up

The 28 36 Rule What Is It And How Does It Affect Your Mortgage

Loan Officers Custom Mortgage

What Are The Qualifications For A Mortgage Loan

Mortgage Broker In Coffs Harbour Sawtell Woolgoolga Mortgage Choice

Free 28 Sample Deed Forms In Pdf